The Importance of Multiple Income Streams

In today’s fast-paced and ever-changing economic landscape, the concept of relying on a single source of income is becoming increasingly risky. Whether you’re a nine-to-five employee, a freelancer, a business owner, or an investor, the importance of diversifying your income streams cannot be overstated. Here are some of the main reasons why having multiple sources of income is crucial for financial security and success.

Economic Uncertainty

One of the most compelling reasons to have multiple income streams is the unpredictable nature of the global economy. Economic downturns, recessions, and unexpected market fluctuations can have a devastating impact on your finances if you rely solely on a single source of income.

Having multiple income streams can help you weather these economic storms more effectively. If one source of income is negatively affected, others may remain stable or even flourish. This diversification can provide a safety net during tough times, ensuring that you can continue to cover your essential expenses and maintain a comfortable lifestyle.

Enhanced Financial Stability

Diversifying your income streams is crucial for achieving enhanced financial stability. When you rely on a single source of income, you are more vulnerable to economic fluctuations and job-related risks. However, by consulting with investment property advisors, you can explore opportunities such as purchasing rental properties, which offer a reliable income source and potential for long-term growth. Property advisor Melbourne experts can provide valuable insights into the local real estate market, helping you make informed decisions to strengthen your financial stability and secure your financial future.

Accelerated Wealth Building

Beyond just providing stability, multiple income streams can accelerate your wealth-building journey. By generating income from various sources, you have the potential to increase your overall earnings, save more, and invest wisely. This can lead to a faster accumulation of wealth and a greater financial cushion for future goals, such as retirement or purchasing a home.

Consider someone who diversifies their income through investments in stocks, real estate, and a small business. As these income streams grow and compound over time, the individual can experience exponential wealth growth compared to relying solely on a single job or income source.

Flexibility and Freedom

Having multiple income streams can also offer you greater flexibility and freedom in your life. It allows you to pursue your passions, explore new opportunities, and take calculated risks. With financial stability provided by diversified income, you may have the ability to change careers, start your own business, or travel without worrying about the loss of a single income source.

Multiple income streams can also give you the freedom to choose how you spend your time. You can reduce your reliance on a traditional 9-to-5 job and have more control over your work-life balance. This flexibility can lead to a more fulfilling and less stressful lifestyle.

Protection Against Inflation

Inflation erodes the purchasing power of your money over time, which means that the same amount of money will buy you less in the future. Having multiple income streams can serve as a hedge against inflation. Some income sources, such as rental income or dividend-paying investments, may increase in value over time, helping you keep pace with or even outpace inflation.

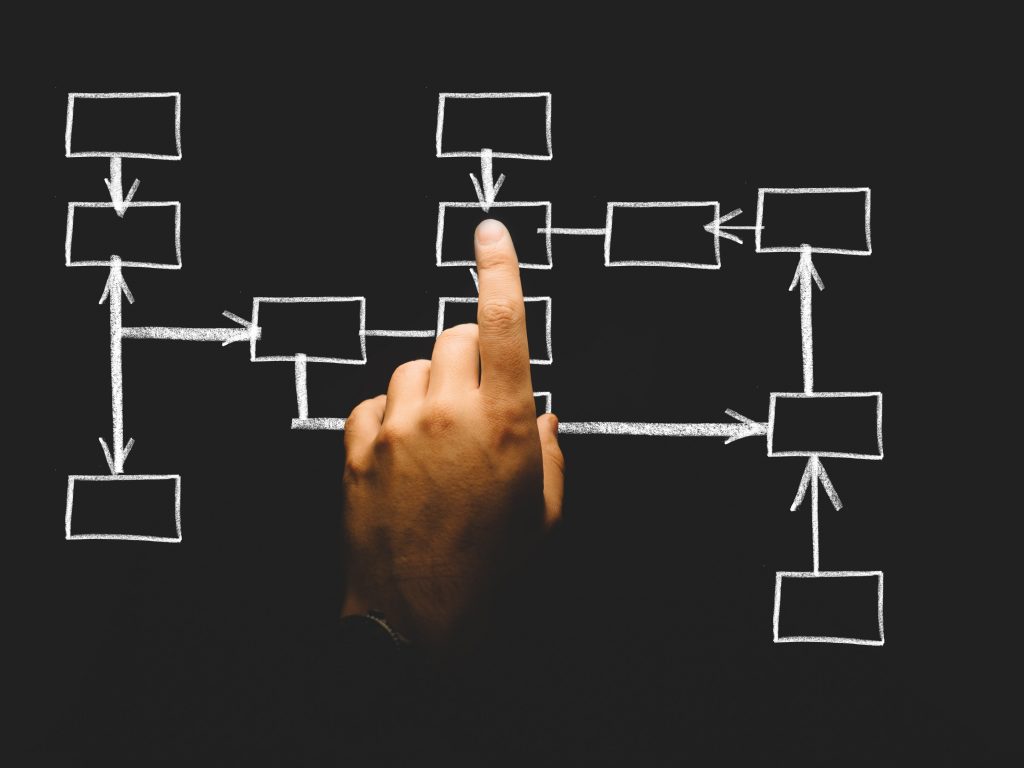

Risk Mitigation

Diversifying your income sources also spreads the risk associated with each source. Different income streams tend to have different risk profiles. For example, a job may come with the risk of layoffs or industry-specific downturns, while investments may be subject to market volatility. By diversifying, you can reduce the impact of any one source’s risk on your overall financial well-being.

Personal Development and Skill Acquisition

Creating and managing multiple income streams often requires acquiring new skills and knowledge. Whether you’re learning about investing, starting a side business, or expanding your freelance services, this process can lead to personal development and growth. As you acquire new skills and diversify your income, you become a more adaptable and resilient individual.

Passive Income Generation

Multiple income streams can also include passive sources of income, such as rental properties, royalties from creative work, or dividend-paying investments. Passive income requires less ongoing effort and time compared to active income sources like a full-time job or a freelance gig. Over time, building passive income streams can allow you to enjoy financial benefits with less active work involvement, providing a greater work-life balance.

All in all, the importance of having multiple income streams cannot be overstated in today’s uncertain economic landscape. Diversifying your income not only provides financial stability and security but also opens up opportunities for wealth building, personal development, and a more flexible and fulfilling lifestyle. While the path to creating multiple income streams may require effort and dedication, the long-term benefits make it a worthwhile endeavour for anyone seeking financial independence and peace of mind.

Economy Online

Economy Online

How can you know you are investing in the ideal technology?

How can you know you are investing in the ideal technology?